Augmented Reality/Virtual Reality Patent Prosecution Update: 2021 Q4 Prosecution Statistics

April 1, 2022

Authored and Edited by Srikanth Jandhyala; Karthik Kumar, Ph.D.; Rajeev Gupta, Ph.D.

In this article, we look at the worldwide data tracking issuance of Augmented Reality/Virtual Reality patents from the fourth quarter of 2021. As a brief overview, Augmented Reality/Virtual Reality (“AR/VR”) generally refers to a class of technologies that merge a view of a real-world environment with virtual objects and information or provide an entirely virtual environment as a user experience. AR/VR technologies are drawing renewed attention due in part to the availability of cheaper and more powerful mobile computing devices, faster and ubiquitous communication networks, plus the increased need for means of remote communication and collaboration in this work from home era. No longer are AR and VR restricted to entertainment and science fiction; they have now expanded into online shopping, workplace training and collaboration, healthcare delivery, and the real estate market, just to name a few. In this series, we track the growth in AR/VR patents worldwide that we expect will accompany the rapid innovation in this technology space. We highlight trends in patenting AR/VR technologies—who is obtaining AR/VR patent protection, and where. We track the various technology centers at the United States Patent and Trademark Office that handle AR/VR applications. And, from time to time, we shine the spotlight on interesting new AR/VR patents.

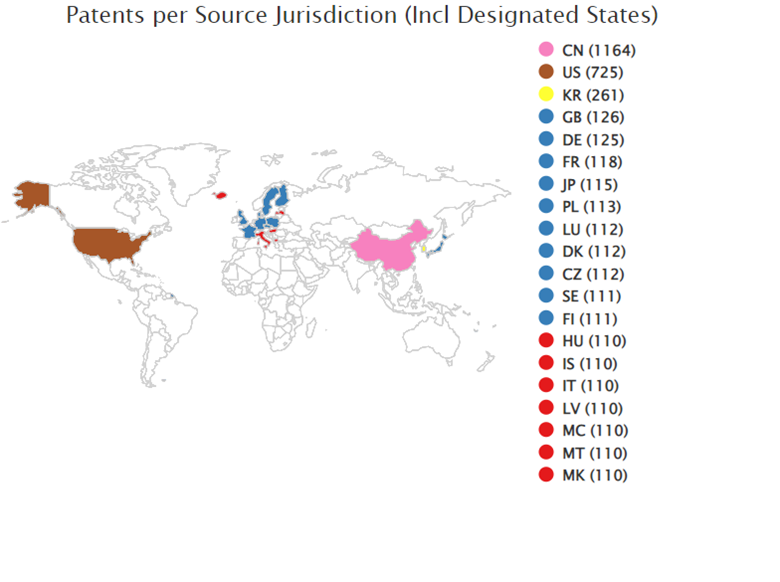

The fourth quarter of 2021 maintained the pace of issued Augmented Reality/Virtual Reality patents. In the fourth quarter of 2021, the intellectual property offices around the world combined to issue over 2564 patents related to AR/VR technologies, a slight drop from the peak of 2735 in Q3 and the least of any quarter overall in 2021. China continued its lead over the United States as the top issuer by volume, with the Chinese patent office (SIPO) issuing 1164 patents compared to 725 patents issued by the USPTO. In the fourth spot, Great Britain led Europe and issued 126 new patents. In Asia, Korea and Japan maintained the pace of issuing newAR/VR patents and are in the top ten spots with 261 and 115 issued patents, respectively.

FIG.1 Top Jurisidictions for AR/VR patenting in Q4 of 2021

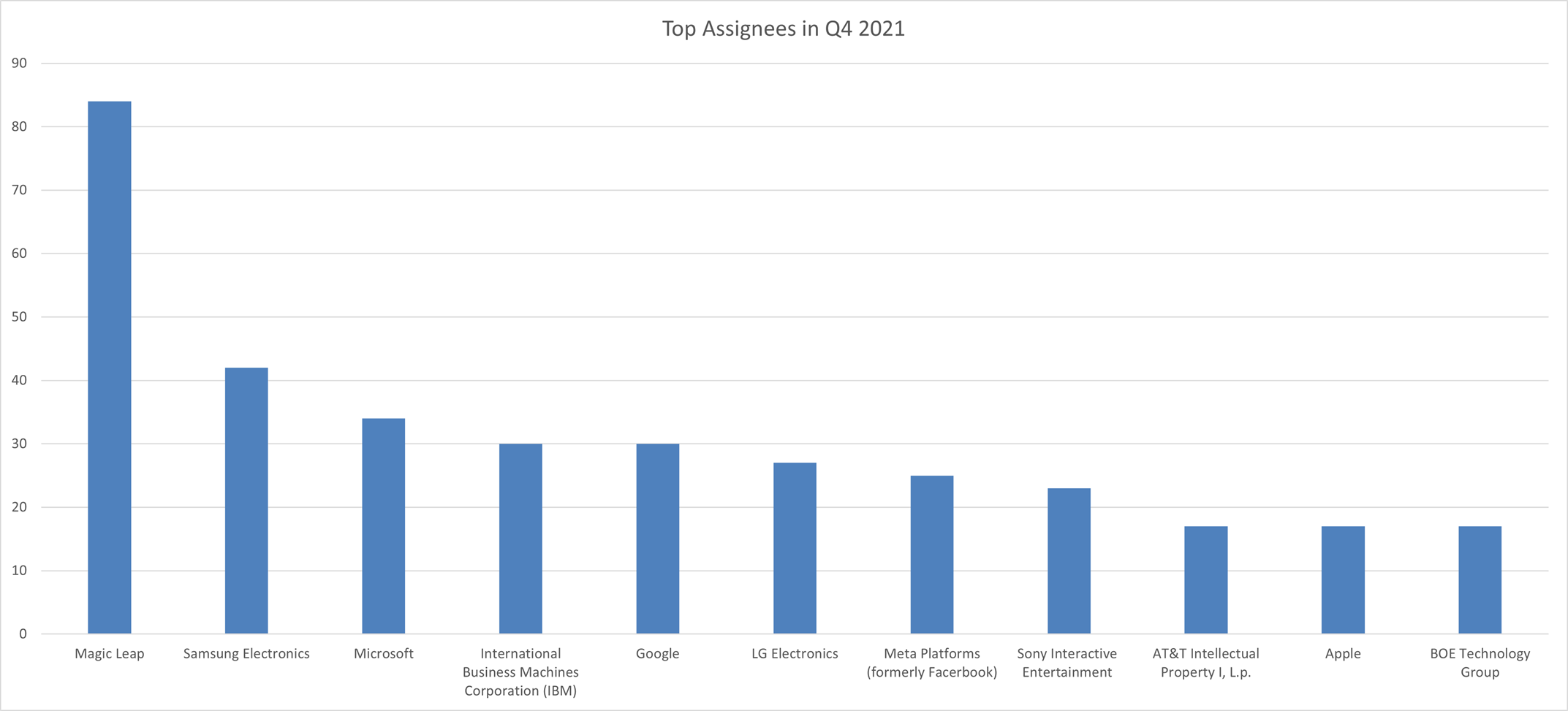

Magic Leap maintained its lead over Microsoft even in the fourth quarter of 2020 as the top assignee, adding 84 new AR/VR patents to its collection, 30% more than the previous quarter and a total of 241 patents in 2021. Both Magic Leap and Microsoft (who acquired 140 patents total in 2021) continue to be the dominant players in the market, and we look forward to seeing how their innovations are presented in future products. Samsung was on close heels placing third for two quarters and second for a quarter, and acquired 113 new AR/VR related patents.

FIG.2 Top ten assignees by volume of AR/VR patents issued in Q4 of 2021

With the final quarter’s data, we return to USPTO Technology Center 2600, which handles a large percentage of AR/VR applications to look at a particular Technology Center Group. Tech Center Group 2610 handles applications specific to computer graphics processing, 3D animation, display color attribute, object processing, and hardware and memory. This group has an average allowance rate of 78.5%. That is 5% more than the average allowance rate a year ago. The increase can be attributed to a significant increase in allowance rate above 90% for the last couple of years. The average allowance rate has increased by 5%. At a 78.5% average allowance rate, prosecution in Tech Center 2600 is relatively smooth compared to other Tech Centers, but the number of patent applications dropped in 2021. As of 2021, pending patent applications have dropped significantly to 7,597 (compared to 22,519 in 2020). The drop could also be attributed to increased allowances above 90% of pending applications from the past couple of years.

For allowed applications in Tech, around 75% had previously faced rejections based on prior art under 35 U.S.C. §§ 102 or 103. Rejections under 35 U.S.C. § 101 are less abundant than other Tech Center Groups, with less than 15% of all applications facing 101 rejection in a first office action, falling down to near 5% in a final office action. The average pendency for patents issued by Tech Center 2600 is 2 years, 9 months, 20 days from filing to issuance, a significant drop from an average of 3.5 years at the end of 2020. The quick prosecution cycles also meant only about 26% of allowed applications had at least one Request for Continued Examination, with only one-fifth of those requiring two or more Requests for Continued Examination. Lastly, applicants have had some success appealing a Final Office Action to the Patent Trial and Appeal Board. Nearly 63% of the outcomes on appeal were in the applicant’s favor.

Design patent protection is available in the U.S. and Canada to protect the ornamental design of an object. (Europe and other jurisdictions operate on a registration system, rather than an examination system.) Companies and inventors may choose to protect hardware or graphical user interface elements using design patents. In the final months of 2021, Magic Leap is back at the top spot with 3 design patents. While Dongguan Linqi Electronics dominated the third quarter, it did not receive any new patents in the fourth quarter.

A Year in Review

The year continued with the uncertainty of the pandemic with Delta and Omnicron variants, but there was no change in the pace of issued AR/VR patents. Facebook rebranding as Meta Platforms Inc. caused increased interest in metaverse of virtual environments. Meta Platforms and Microsoft showcased how virtual world networks are the future for both doing work and having fun. Chinese patent office took over the top spot from the USPTO in the fourth quarter of 2020 for the total issued patents by volume maintained that lead throughout 2021. The chart below highlights some of the data gathered over the past year, and we will continue tracking in 2022.

|

2021 Worldwide |

Q1 |

Q2 |

Q3 |

Q4 |

|

AR/VR Utility Patents Issued |

2709 |

2698 |

2735 |

2564 |

|

Top Jurisdiction |

Chinese Patent Office |

Chinese Patent Office |

Chinese Patent Office |

Chinese Patent Office |

|

Top Assignee |

Magic Leap |

Magic Leap |

Magic Leap |

Magic Leap |

|

AR/VR Design Patents Issued |

10 |

13 |

10 |

10 |

Fig. 3 A quarter-by-quarter comparison for top metrics in 2021

Patent Prosecution Statistics Methodology

Our analysis includes a search of all patents granted around the world in the fourth quarter of 2021, from October 1 to December 31, for keywords in the title, abstract, or claims related to AR/VR technologies. We then review the data to determine which offices are issuing relevant patents and which companies are focusing on protecting their innovations in the different parts of the world. For design patents, the same search was run, however, we note that the search was limited to the United States and Canada as design protection differs worldwide

Related Practices

Related Industries

Related Offices

Contacts

Copyright © 2022 Finnegan, Henderson, Farabow, Garrett & Dunner, LLP.

DISCLAIMER: Although we wish to hear from you, information exchanged in this blog cannot and does not create an attorney-client relationship. Please do not post any information that you consider to be personal or confidential. If you wish for Finnegan, Henderson, Farabow, Garrett & Dunner, LLP to consider representing you, in order to establish an attorney-client relationship you must first enter a written representation agreement with Finnegan. Contact us for additional information. One of our lawyers will be happy to discuss the possibility of representation with you. Additional disclaimer information.