How Many Patents Does Your Company Really Need?

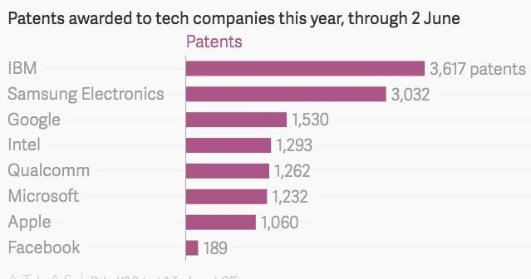

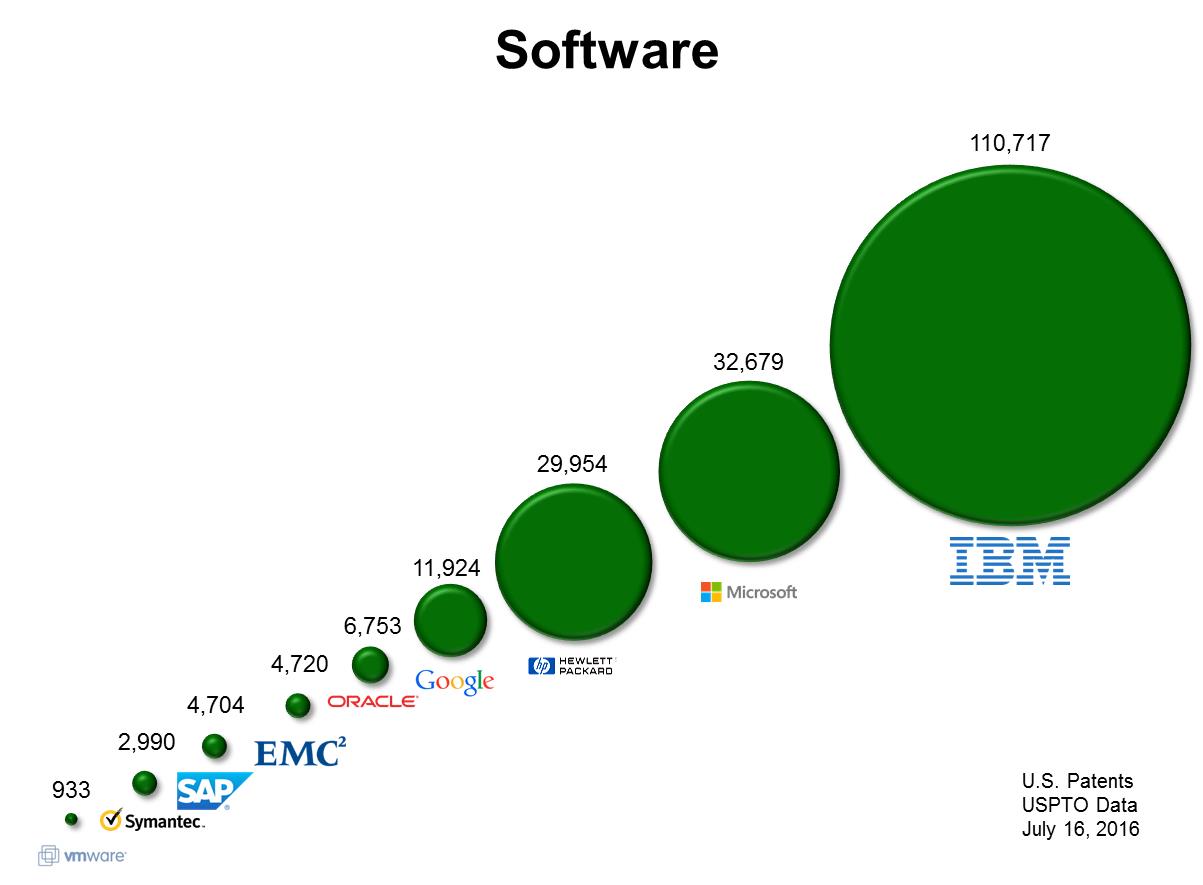

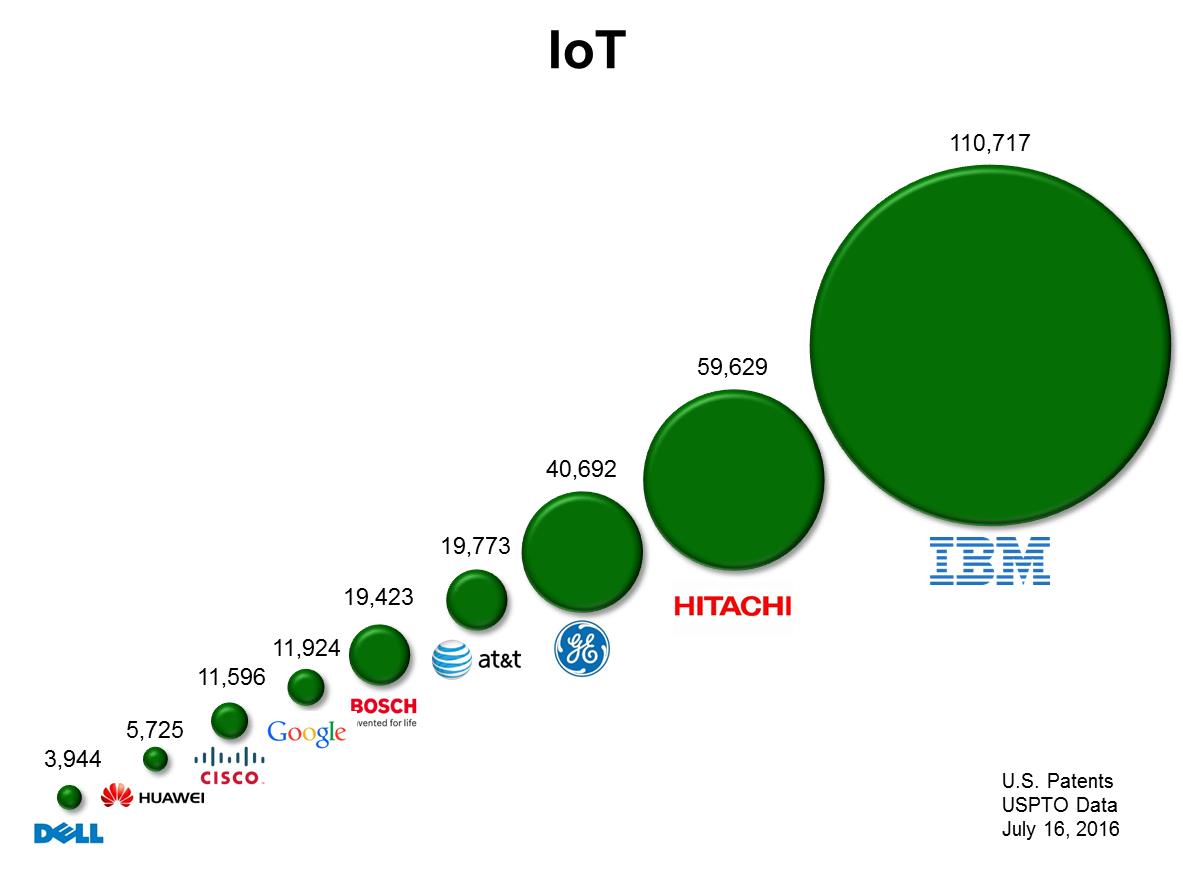

A study of U.S. issued patents reveals that in the first five months of 2016, IBM received an average of 24 U.S. patents per day. Other high profile companies like Samsung, Google, Intel, Qualcom, Microsoft, and Apple also scored quite high.

These statistics beg the question: “What is a reasonable number of patents for my company to obtain?” Guidelines applicable to your company, and graphs showing how your company fits in, are provided here.

While there are no hard and fast rules about how many patents any given company should obtain, the following guidelines may be valuable.

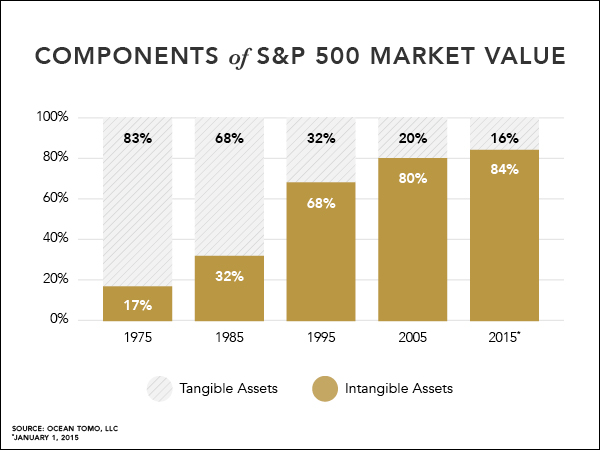

- Patents are your core asset: Regardless of your industry sector, patents are likely to be the core asset of your business. This is because, in a world where valuation is tied to intangible assets—the most significant of which are the ideas underlining your propriety technology—patents are a major way to protect and grow your valuation. In the absence of patents that block competitors from using you innovations, a competitor might freely take your ideas and sell them to others. If this happens, your company’s valuation will be significantly impacted.

The chart above summarizes a study by Ocean Tomo revealing that intangible assets, such as patents, copyrights, trade secrets, and trademarks, contribute 84% of the S&P 500’s value. Unlike the 1970’s and 80’s where a company’s worth was primarily judged based on the physical assets and cash it owned, today valuation is mostly about a company’s non-physical assets.

- In order to contribute to value, patents must be strategically developed. Not all patents are created equal. In fact, many analysts repeat the statistic that 95%-97% of patents are worthless. This is because patents are delicate instruments that must be precisely aligned with both your business goals and the hundreds of court-imposed and patent office-imposed rules that apply to patent development. A well-written technical document, alone, often does not qualify as a strong patent. If your company’s patents are not strategically developed and tested in advance by patent litigators accustomed to finding and exploiting flaws in patents, your patents may make beautiful wallpaper, yet do nothing to stop competitors.

- Startup companies should file at least 5-8 strategically written, litigation-ready patent applications in the first two years. As a general rule of thumb, startup technology companies in the medical device, hardware, software, cybertech, and biopharma fields, and others, should plan to engage a strategic patent planner in the first year, and working together, develop and test at least 5-8 blocking positions that can be included in patent applications filed in the current year and succeeding year. Investors are becoming very sophisticated when it comes to patents. They no longer look for a particular number of patents. Rather, they evaluate patent quality for exclusivity value. If done right, a strategic patenting program should provide savvy investors and acquirers with the confidence they need to make a meaningful investment in your company.

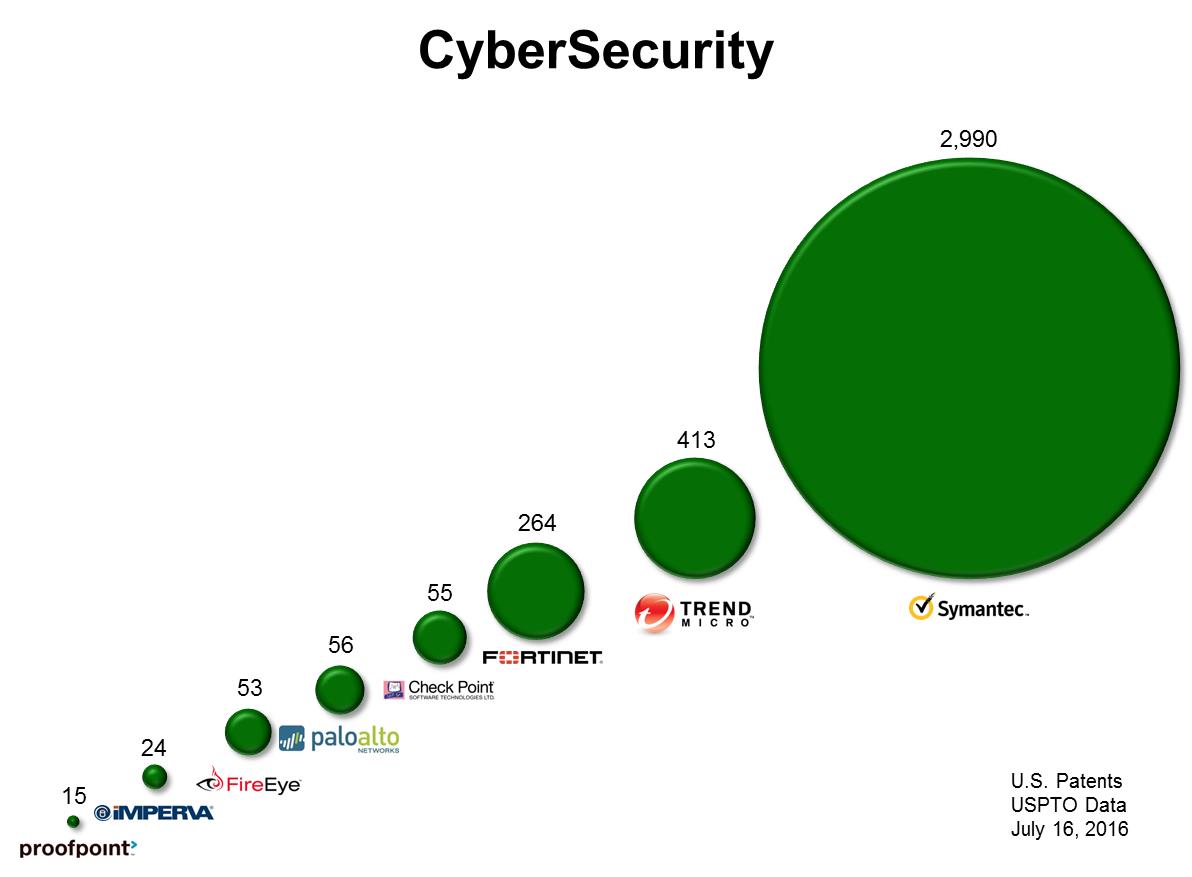

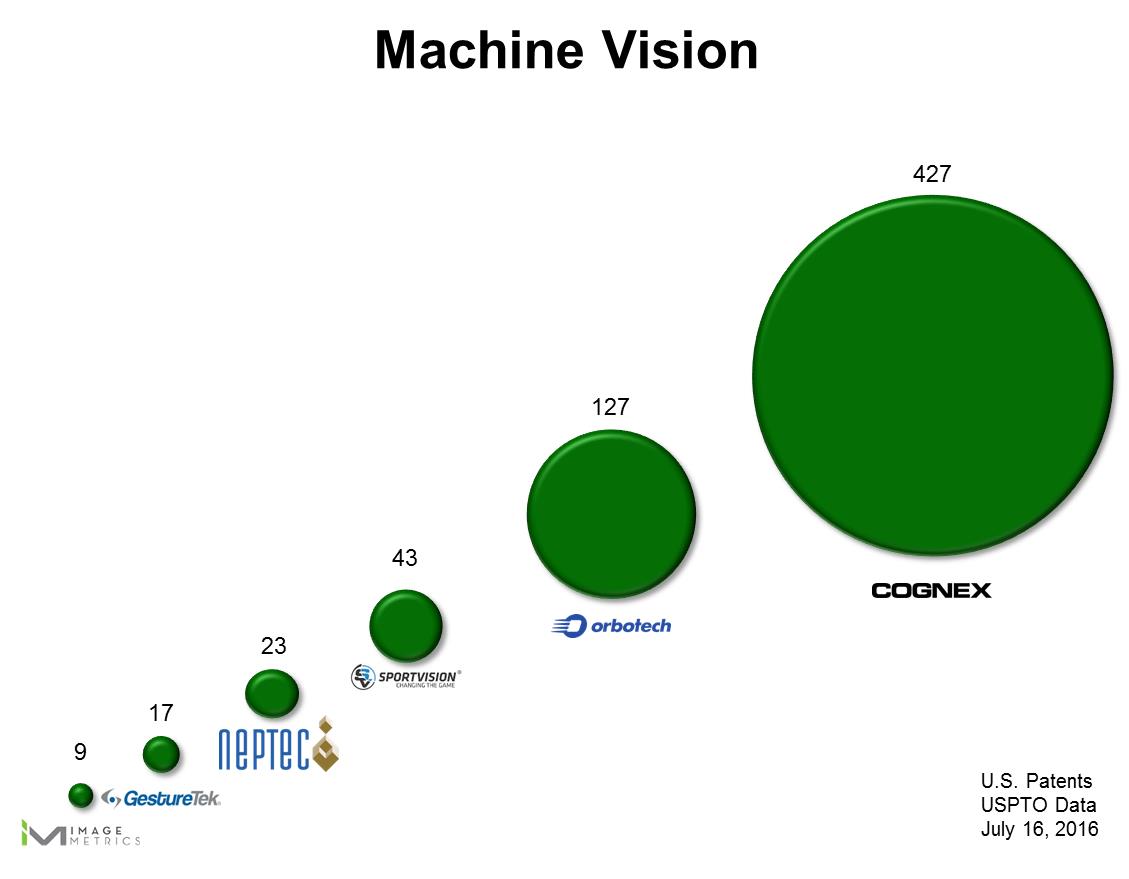

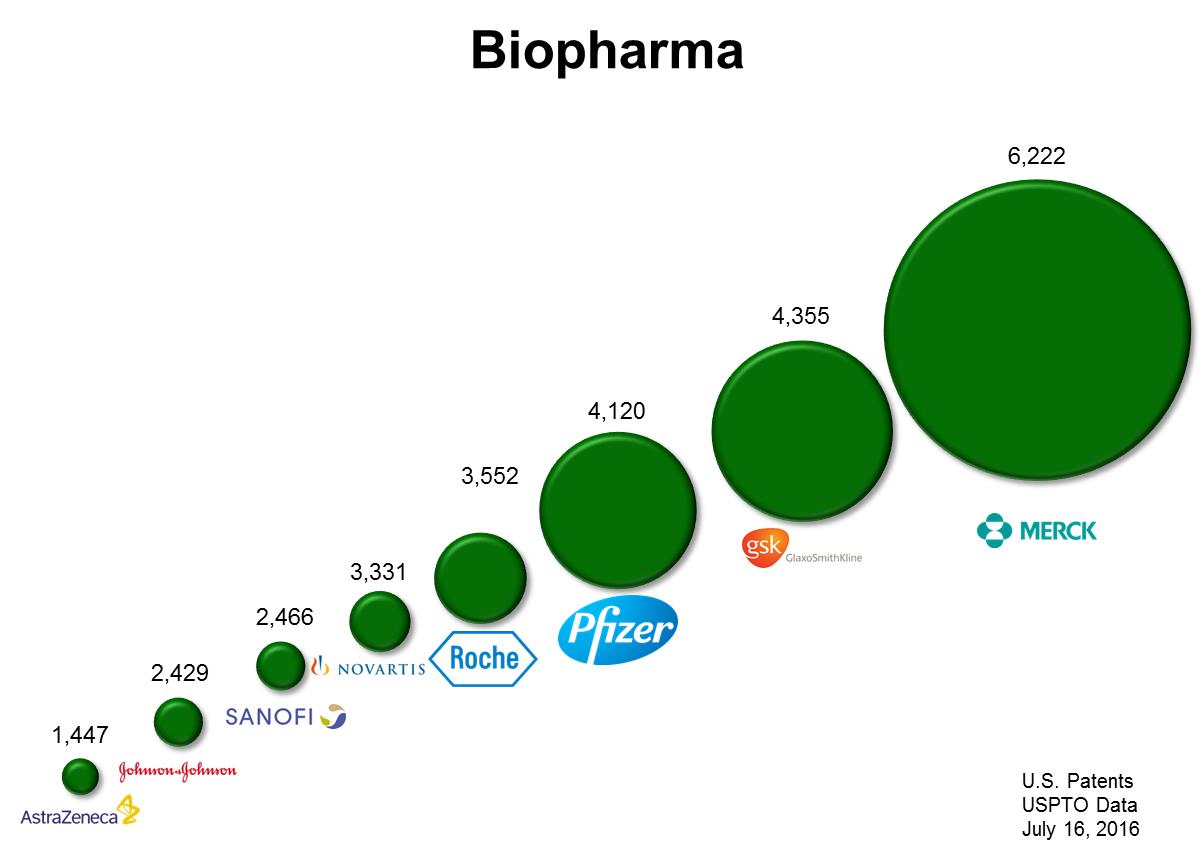

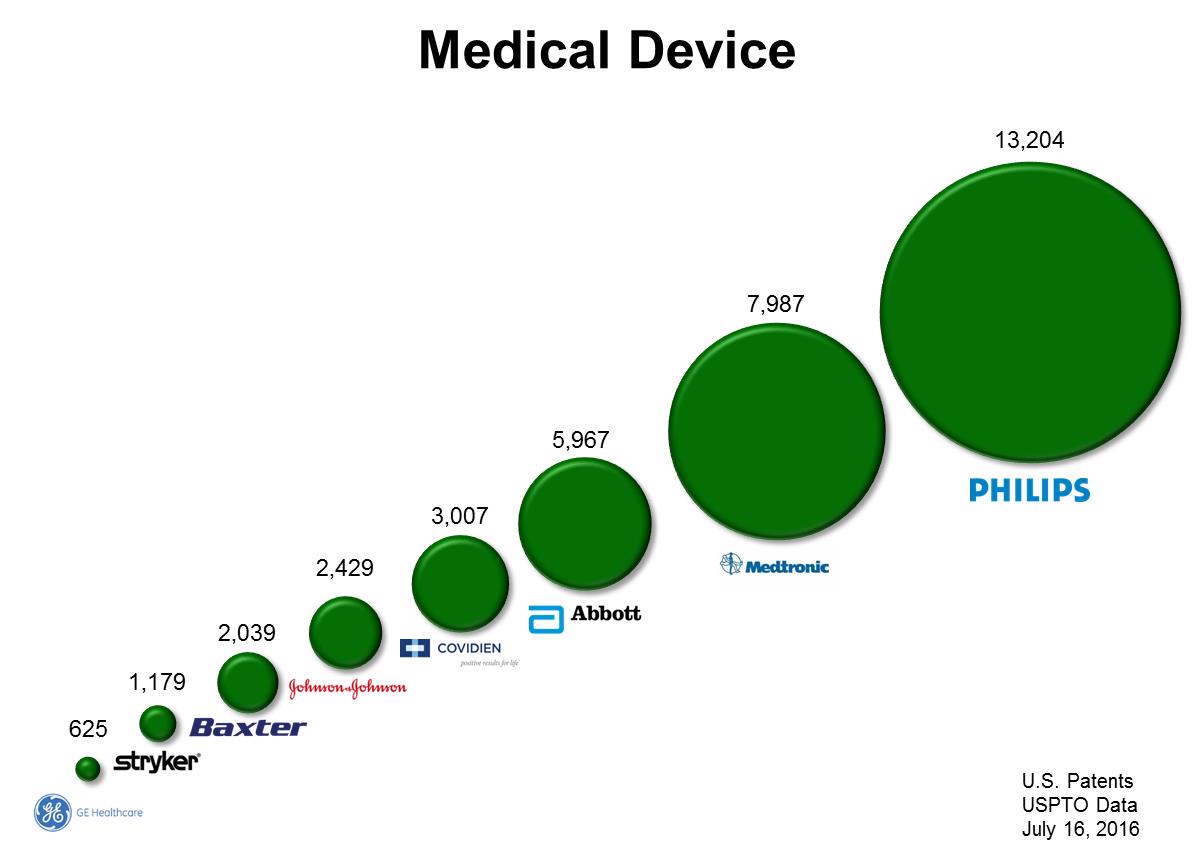

- Competitor’s patent positions should provide a long term guideline for your company’s patenting efforts. Since patents are now the currency companies use to trade their way out of disputes that would otherwise threaten a company’s existence, it’s a good idea to consider the patenting activity of your major competitors as a guideline for your own patenting activity. Of course, startups often lack the resources to pursue numerous patent applications simultaneously. However, the following graphs provide benchmarks to consider as funding becomes available. While it is true that companies need to balance their budgets appropriately to cover many items other than patenting, with patents contributing so significantly to valuation, patents can no longer be an afterthought.

|